Key Takeaways

- Market Opportunity: India represents the world’s biggest commercial aviation market with projected 7% annual traffic growth through 2043

- Manufacturing Prerequisites: Boeing requires substantially larger aircraft orders before establishing final assembly operations in India beyond current USD 1.25 Billion annual sourcing

- Trade Policy Navigation: Company advocates for zero-tariff aerospace policies while managing impact of 26% US reciprocal tariffs on Indian imports

- Current Operations Scale: Boeing employs 7,000+ people directly in India with 13,000+ additional roles through 300+ supply chain partners

- Strategic Infrastructure: Established engineering centers in Bengaluru and Chennai plus distribution facilities supporting regional growth

Aerospace Giant Reinforces India Commitment Despite Trade Policy Headwinds

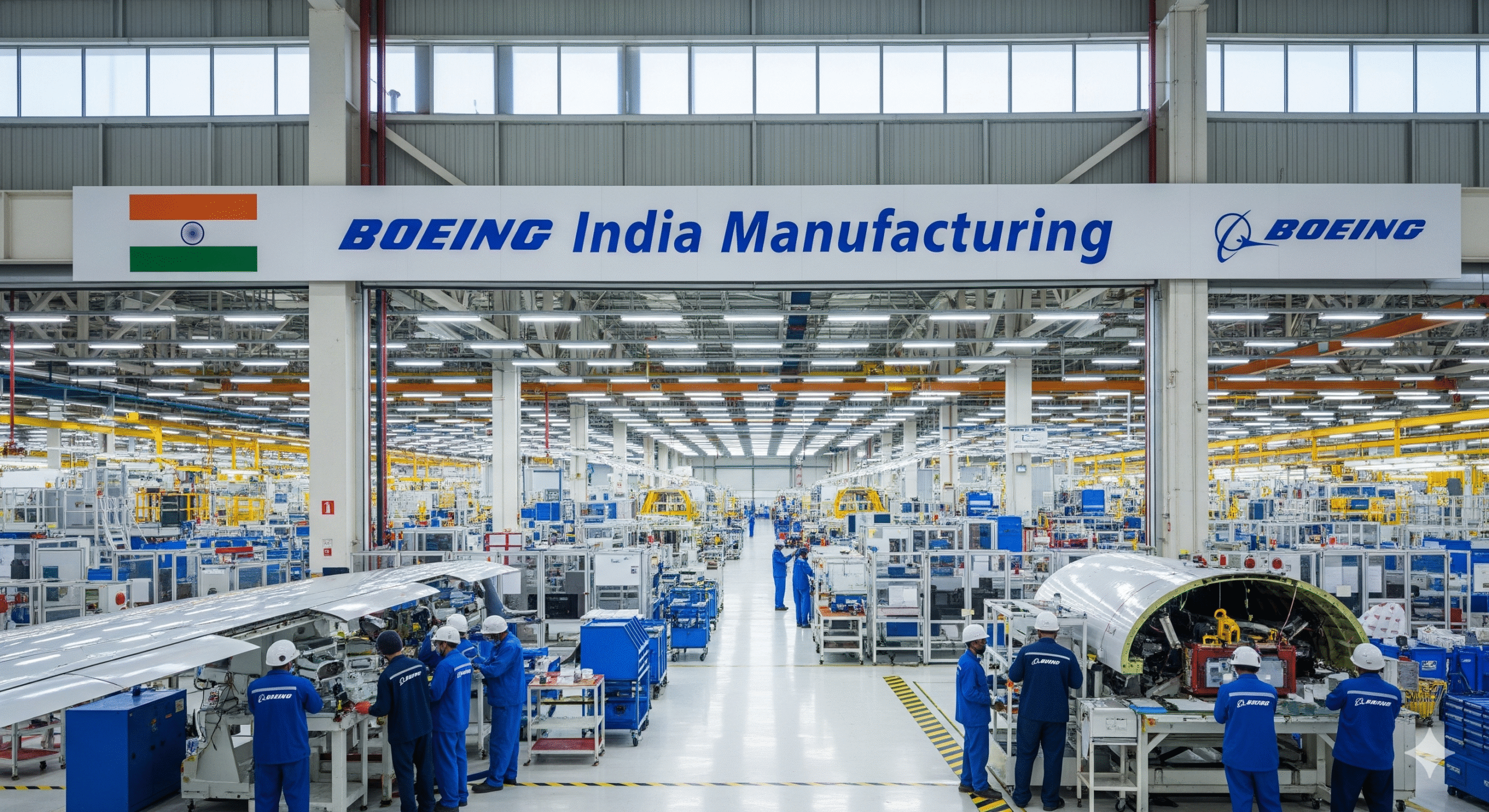

Boeing Corporation continues to strengthen its manufacturing footprint and strategic partnerships across India as the aerospace industry navigates complex trade policy developments between the United States and one of its most promising aviation markets. The company’s leadership has outlined ambitious growth projections while emphasizing the need for expanded order volumes to justify major manufacturing investments.

According to senior Boeing executives, India’s commercial aviation sector represents unprecedented growth potential, with the South Asian region projected to witness quick growth in the commercial aviation market globally. Boeing forecasts indicate the region will experience more than 7% annual traffic growth, with India’s commercial airplane fleet expected to grow nearly four-fold through 2043.

Manufacturing Strategy Requires Scale for Viability

Boeing President for India and South Asia, Salil Gupte, recently emphasized that establishing final civil aircraft assembly operations would require “far larger” orders than current Indian market volumes. The company maintains that while India’s aviation growth trajectory remains compelling, manufacturing decisions must align with substantial order commitments that justify major capital investments.

The aerospace manufacturer currently operates extensive supplier relationships across India, generating approximately USD 1.25 Billion in annual sourcing through a network exceeding 300 suppliers. These partnerships support Boeing’s global engineering initiatives through dedicated facilities in Bengaluru and Chennai, employing over 7,000 people directly while supporting an additional 13,000 positions through supply chain collaborations.

Trade Policy Developments Create Industry Uncertainty

Recent US trade policy adjustments have introduced new variables into aerospace manufacturing calculations. The Trump administration implemented a 26% reciprocal tariff on Indian imports in 2025, with additional penalties related to energy procurement policies, bringing combined tariff rates to potentially 50% on certain goods.

These policy shifts particularly impact Boeing’s extensive supplier relationships throughout India, where the company sources components for its 737 aircraft series and other platforms. Industry analysts note that Boeing imports parts from its Sheffield, England facility while maintaining its substantial USD 1.25 Billion annual sourcing from Indian suppliers.

Industry Advocates for Aerospace-Specific Trade Provisions

Boeing executives have recently expressed confidence in potential trade agreement negotiations while advocating for zero-tariff policies specifically for aerospace products. This position reflects broader industry sentiment that aviation manufacturing requires specialized trade considerations given the global nature of aerospace supply chains and lengthy development cycles.

The company’s advocacy efforts align with industry concerns about tariff impacts on major US exporters. Aviation consultancy experts emphasize that broad tariff applications may inadvertently burden America’s largest goods exporters, suggesting more targeted approaches for trade policy implementation.

Growth Projections Drive Long-Term Optimism

Despite near-term trade policy uncertainties, Boeing maintains strong confidence in India’s aviation market fundamentals. Company projections indicate Indian carriers will require over 2,000 new single-aisle aircraft over the next two decades, with fuel-efficient models like the 737 MAX accounting for nearly 90% of commercial jet deliveries in the forecast period.

The Commercial Market Outlook forecasts indicate India’s cargo freighter fleet will grow 5x as a consequence of the region expanding its role in advanced manufacturing, global supply chains, and e-commerce operations. This growth trajectory supports Boeing’s strategic positioning within India’s expanding aviation ecosystem.

The company’s current partnerships include collaboration with GMR Aero Technic for 737 Boeing Converted Freighter operations in Hyderabad, plus ongoing relationships with major Indian carriers such as Air India, SpiceJet, and Akasa Air. Additionally, Boeing maintains its India Distribution Center in Khurja, Uttar Pradesh, featuring 36,000 square feet of parts warehousing to enhance fleet utilization and mission readiness. As India continues developing as one of the world’s largest civil aviation markets, Boeing’s manufacturing strategy will likely evolve alongside market demand, trade policy developments, and infrastructure investments that support the country’s ambitious aviation growth objectives.